Services for

FINANCIAL PLATFORMS

Increase the Margin of Your Digital Channels.

Services for

WEALTH MANAGEMENT

Empower Your Client Advisors to Exceed Client Expectations

Services for

ASSET MANAGERS

Win Time and Performance With Radically Different Investment Information.

We empower client advisors

We increase margins of digital channels

NEWS

DXtrade and theScreener Announce Partnership!

DXtrade, the flagship multi-asset trading platform from global software developer for the capital markets, Devexperts, and theScreener, the data analysis and intelligence provider, have announced their partnership. theScreener will complement DXtrade’s broad offering,...

Modernization & Reshoring: Tailwinds for Machinery Makers!

While tech dominates the headlines, AI and robotics are quietly transforming nearly every corner of industrial production – making new, high-capacity machinery essential. At the same time, advanced manufacturing technologies are fueling the politically favored...

When Trust Fades, Gold Shines!

Think debt mountains, geopolitical tensions, unaffordable defense budgets, and economic uncertainty will vanish in 2026? Then gold isn’t for you. But if those risks linger—and all signs point that way—the surge in gold mining stocks could be far from over. As...

theScreener Feed

Become the preferred financial platform

Star Rating

Sensitivity Rating

theScreener Feed is our data feed solution for easy integration of theScreener’s ratings and analysis into online-/mobile-banking applications, core-banking, portfolio management and brokerage systems.

- Increase customer loyalty

- Generate relevant alerts

- Visualize portfolios meaningfully

- Improve your client`s experience

- Enhance trading activity

Increase customer loyalty by providing timely high-quality interactions, trading confidence and competence with theScreener Feed.

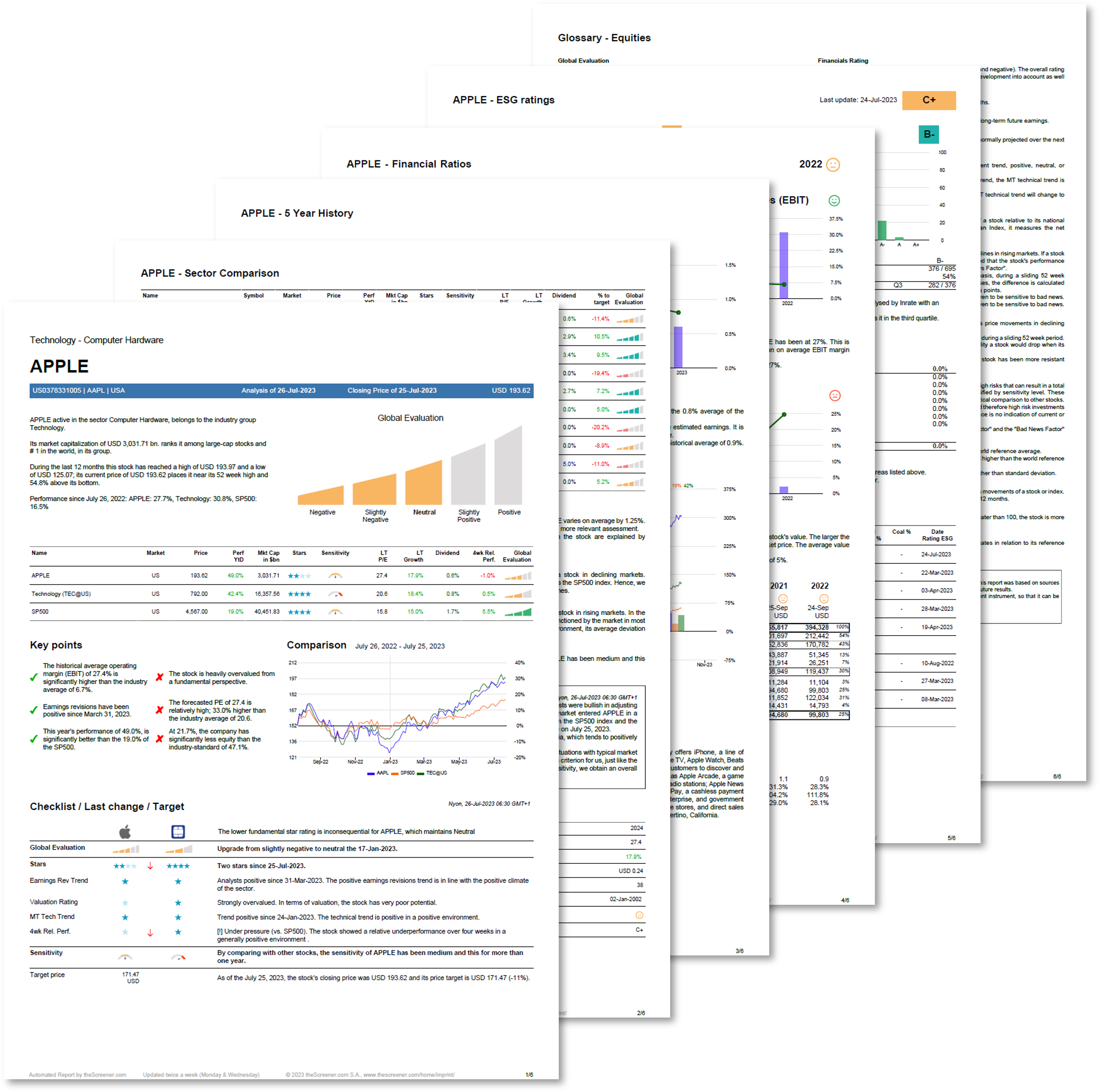

theScreener RM

Empower Your Client Facing Professionals

theScreener RM enables Client Advisors to answer a wide array of reverse enquiries competently and consistently. Exceed the client’s expectation with our multilingual research reports at the click of a button.

- Global coverage of equities, markets, industries, sectors and funds

- Multilingual ready-to-print reports

- Always up-to-date

- Transparent evaluation methodology

- Off-the-shelf solution

- Easy to use

Give your Client Advisors the tools to shine with the reports and analyses of theScreener RM.

theScreener CIO

Beyond Data – Insight

theScreener CIO is the radically different, all-in-one web application, designed for portfolio and fund managers to make better investment decisions.

- Global coverage of equities, markets, industries, sectors and funds

- Management of in-house content and communication

- Transparent evaluation methodology

- Off-the-shelf solution

- Easy to use

Discover the unique experience of navigating the global investment universe in an unparalleled refreshing and effective way.

Why Choose Us

We've been doing this for quite a while

Your Subtitle Goes Here

For over 20 years we have been passionate about helping the buy-side exceed client expectations and this passion continues to drive us today and into the future. Our highly dedicated team of analysts, portfolio managers and IT professionals has created a unique multi-dimensional approach, which blends fundamental, technical, valuation and risk evaluations seamlessly into one single easy-to-use front-end.

After years of research and development we are able to provide investors with the most advanced basket of decision support solutions available. Through our work with leading names in the industry, we have earned the reputation as a trusted partner for success.

We are radically different

Your Subtitle Goes Here

Uniqueness is at the core of our value proposition. Our technology-enabled research is radically different from anything else in the market. Our unparalleled solution translates complex financial analysis into intuitive and easy-to-understand metrics and language. We cover not only thousands of equities worldwide, but also publish hundreds of sector and market studies every week. All reports can be tailored to your needs and are published in several languages.

Our CIO application is radically different from any other financial information package in the market. From the fresh design to the easy navigation and intuitive functionalities – there is nothing comparable in the industry for the professional investor. We believe that theScreener application is the most distinctive and useful tool available in the market today.

Our data feed is radically different from any other data feed available and whatever other content you use on your web- or mobile applications today, our data feed empowers you to significantly refresh your existing solutions and to make them considerably more valuable for your clients.

By continually applying cutting-edge technology, theScreener has been delivering unique and innovative solutions for over two decades. Uniqueness will always remain at the core of our value proposition.

We use cutting-edge technology

Your Subtitle Goes Here

Algorithms are the DNA that drives all our products. Our proprietary model and cutting-edge technology help to overcome the limitations and risks inherent in traditional financial analysis. We use the latest generation technology to improve the quality of the raw data taken into our systems and then to analyze this data robustly in order to reach clear and intuitive conclusions, which are presented in a client-friendly way. Our systematic approach delivers efficient, transparent and consistent results which are repeatable and fully documented.

We work with the best

Your Subtitle Goes Here

Our ratings and analysis are used by top-tier banks, asset managers, online-brokers and portals, as well as institutional investors. We are known for having an outstanding track record in delivering real results. Today we are recognized as one of the leading independent equity research and fund research companies in the world.

By focusing on the core and long-term needs of our clients, we have become the partner of choice for many clients, including global Fortune 500 companies who serve millions of end users with our data, making theScreener the trusted leader in financial analytics.

We're known for excellent customer support

Your Subtitle Goes Here

Communication and transparency are vital to us. We listen to you and your needs and deliver on what we promise. We take our work very seriously, but we don’t take ourselves too seriously. We love doing what we do and we hope you’ll love working with us.

Any questions? We are available all day by phone and email. We look forward to hearing from you.

PARTNERS

To provide you with the best possible performance and seamless integration, we work with industry leaders and specialized suppliers.

ABOUT US

Who we are

Founded in 2000, theScreener is one of the first Swiss-based fintech companies. Initially, we started-out as a joint venture of financial experts and IT professionals to become one of the most-respected financial analysis platforms available in the market today. Since 2000, we have established an enviable reputation for delivering high-quality, systematic and professional analysis to finance professionals. theScreener – Global Provider of Technology Enabled Research.

What we do

theScreener provides independent equity research based on a powerful proprietary model and a broad range of financial indicators to identify investment ideas and manage downside risk. With over 6’500 companies worldwide, 15’000 funds/ETFs, 18 industry groups, 104 sectors, 44 countries and 55 indexes, evaluated twice a week, theScreener offers unparalleled coverage.

Our unique research blends fundamental, technical and risk metrics to provide actionable insight into your investment process.

Why we do this

At theScreener we believe that using the right tools and information will give any investor an edge in making smarter investment decisions.

Our goal is empowering Investors to make the right investment decisions by leveraging our systematic and objective model, saving you time and delivering real results.

MANAGEMENT

CEO

Andreas Lusser was an UBS executive in structured finance and the telecommunications industry before co-founding theScreener. Andreas Lusser holds a degree in electrical engineering from the Swiss Federal Institute of Technology and an MBA from IMD in Lausanne.

CTO

François Cleyet has more than 25 years of experience in IT coding, service and development. He joined theScreener in 2000, where he assumed various responsibilities before being appointed as Chief Technology Officer, CTO. François CLEYET is a graduate of INSA Lyon.

OFFICES

Eysins

theScreener.com SA

Route de Crassier 7

CH-1262 Eysins

Switzerland

phone +41 22 365 65 65

Zug

theScreener Investor Services AG

Zugerbergstrasse 12

CH-6300 Zug

Switzerland

phone +41 41 727 08 80

Singapore

theScreener Asia Pte. Ltd.

140 Paya Lebar Road

#07-20

Singapur 409015, SG

phone +65 6670 6842

CONTACT US DIRECTLY