With the outlook for other sectors deteriorating, we tend to shift into defensive sectors such as pharmaceuticals. Which companies look promising, which fit which investor style, and who are the winners and losers in this sector this year? This and much more can be...

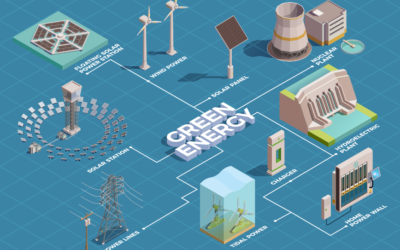

Renewable Energy Equipment: Does clean energy bring clean returns?

Shareholders of renewable energy equipment producers could mainly dream of clean returns during the last two years. In recent weeks, however, analysts have sharply increased earnings expectations in the sector. Even though the market has not yet reacted, we think it...

European Banks: Spring bloom after a very long winter?

European banks have experienced a challenging decade, with many struggling to adapt to increasing and constantly changing regulatory requirements, as well as to a difficult economic environment. As a result, they have lost significant ground in terms of growth,...

Australia: Advantage wideness!

The tennis world has been looking to Australia for the last two weeks and was rewarded with the most exciting matches at the Australian Open. For us, this is an opportunity to take a closer look at the market from an investment perspective. Australia scored last year...

FTSE100: Juicy dividends and more?

The British have not had an easy year politically and socially. Their interest rates have risen earlier and more sharply than all around, while the GBP, which until September only knew the way down, has since gained more than 10% against the USD. And the equity...