METHOD

APPROACH TO STOCK ANALYSIS

Our analyses are conducted twice a week (on Monday and on Wednesday) using the previous closing price.

theScreener‘s Global Evaluation

The Global Evaluation is designed to give a fast and easy yet broadly supported evaluation of a stock. It combines the impression of fundamental and technical elements (valuation, earnings revisions, technical factors, group benchmarking) with the sensitivity rating (Bear Market & Bad News Factor). A better rating in the individual areas leads in the sum to a better Global Evaluation (scoring model).

Best possible rating ![]()

Weakest possible rating ![]()

theScreener‘s Star Rating System: Quality

theScreener‘s star rating system is designed to enable you to identify high-quality stocks quickly and easily. In this easy-to-use rating system, stars are earned for each element specified below:

Earnings Rev Trend  =

=

Valuation Rating  ,

,  ,

,  =

=

MT Tech Trend  =

=

4 week Rel Performance >1% =

Therefore, a stock can earn a maximum of four stars. The lowest rating a stock can have is no stars. Note: For each category, once a stock has earned its star, it will keep it until:

Earnings Rev Trend => The arrow turns red

Valuation Rating => The arrow turns red  or

or

MT Tech Trend => The arrow turns red  and is not oversold

and is not oversold

4 week Rel. Performance => Drops below -1% and is not oversold

7wk EPS Rev

This is an abbreviation for 7 week Earnings Per Share Revision. This column concerns the value of these revised earnings. A figure of 2.8 implies that the analysts, compared with seven weeks ago, have now revised and raised their estimates by 2.8%. On the contrary, a negative number means that the earnings were revised at a lower estimate.

Earnings Rev Trend

The symbol  implies that compared with their earnings revisions of seven weeks ago, the analysts have now raised their estimates (7wk EPS Rev; > 1%); the symbol

implies that compared with their earnings revisions of seven weeks ago, the analysts have now raised their estimates (7wk EPS Rev; > 1%); the symbol  indicates that compared with their earnings revisions of seven weeks ago, the analysts have now lowered their estimates (7wk EPS Rev <−1%).

indicates that compared with their earnings revisions of seven weeks ago, the analysts have now lowered their estimates (7wk EPS Rev <−1%).

When the earnings revisions (7wk EPS Rev) fall between +1% and −1%, the trend is considered to be neutral  .

.

The symbol  indicates that the revisions previous to the neutral situation were positive.

indicates that the revisions previous to the neutral situation were positive.

The symbol  indicates that the revisions previous to the neutral situation were negative.

indicates that the revisions previous to the neutral situation were negative.

Valuation Rating

Our Valuation Rating indicates if a stock is selling at a relative premium or bargain price, based on its earnings potential. To estimate a stock’s value relative to its current price our Valuation Rating combines:

- stock price

- projected earnings

- projected earnings growth

- dividends

There are five ratings, ranging from undervalued  to overvalued

to overvalued  .

.

MT Tech Trend

The MT Tech Trend indicates the current, dividend-adjusted technical tendency (positive  or negative

or negative  ). The Tech Reverse indicates to which price this tendency is valid.

). The Tech Reverse indicates to which price this tendency is valid.

When a price falls between 1.75% above or below the Tech Reverse, the MT Tech Trend is considered neutral  . Once the price breaks out of the +1.75% neutral zone, the MT Tech Trend will change to positive or negative depending on the movement.

. Once the price breaks out of the +1.75% neutral zone, the MT Tech Trend will change to positive or negative depending on the movement.

The symbol  indicates that the MT Tech Trend previous to the neutral situation was positive.

indicates that the MT Tech Trend previous to the neutral situation was positive.

The symbol  indicates that the MT Tech Trend previous to the neutral situation was negative.

indicates that the MT Tech Trend previous to the neutral situation was negative.

4wk Rel Perf

This figure measures the performance of a stock relative to its national or regional index (compared to four weeks ago).

Oversold

Stocks and industries below the oversold threshold (bottom 15% of the volatility channel) are deemed oversold from a technical perspective and the two technical stars are automatically activated.

LT Growth

This is the estimated annual growth rate of future earnings, normally projected over the next two to three years, and expressed as a percentage.

G/PE Ratio

It is the basis of our Valuation Rating. This is the estimated growth of future earnings (LT Growth) plus dividend in %, divided by the estimated future PE ratio (Long Term P/E).

Bad News Factor

To determine the Bad News Factor, we analyze a stock’s dividend-adjusted declines in rising markets. In this purely objective analysis, the actual reasons for a stock’s behavior are not important. If a stock price falls while its relative index goes up, it can be assumed that the stock’s performance has been affected by bad news – hence the name, Bad News Factor.

The Bad News Factor shows the average deviation per bad news event between the stock and its reference index over the last 52 weeks. The Bad News Factor is expressed in basis points.

The higher the Bad News Factor, the more a stock has been sensitive to bad news. The smaller the Bad News Factor, the less the stock has been sensitive to bad news.

Bear Market Factor

To determine the Bear Market Factor we analyze the relationship between a stock’s dividend-adjusted price movements and declining markets, hence the name, Bear Market Factor.

The Bear Market Factor expresses in basis points the average difference over 52 weeks between the moves of the stock price and the moves of the reference and only during declines of the reference index.

The higher the « Bear Market Factor », the more a stock has dropped when its relative index dropped. A Bear Market Factor that is strongly negative means the stock has been more resistant to losses in declining markets.

Sensitivity

Stock price developments are generally volatile and contain high sensitivity that can result in a total loss. Based on their historical behaviour, stocks are classified by sensitivity level. These sensitivity levels have to be considered solely in relative historical comparison to other stocks. Please note that even Low Sensitivity stocks are equities and therefore high-sensitivity investments that can lose up to all of their value, and that past performance is no indication of current or future performance.

Sensitivity is determined by measuring the Bear Market Factor and the Bad News Factor against its benchmark. There are three grades of sensitivity levels:

- Low Sensitivity: The sensitivity indicators fall below the world reference average.

- Moderate Sensitivity: The sensitivity indicators are situated higher than the world reference average, but lower than the standard deviation.

- High Sensitivity: The sensitivity indicators are at levels higher than the standard deviation.

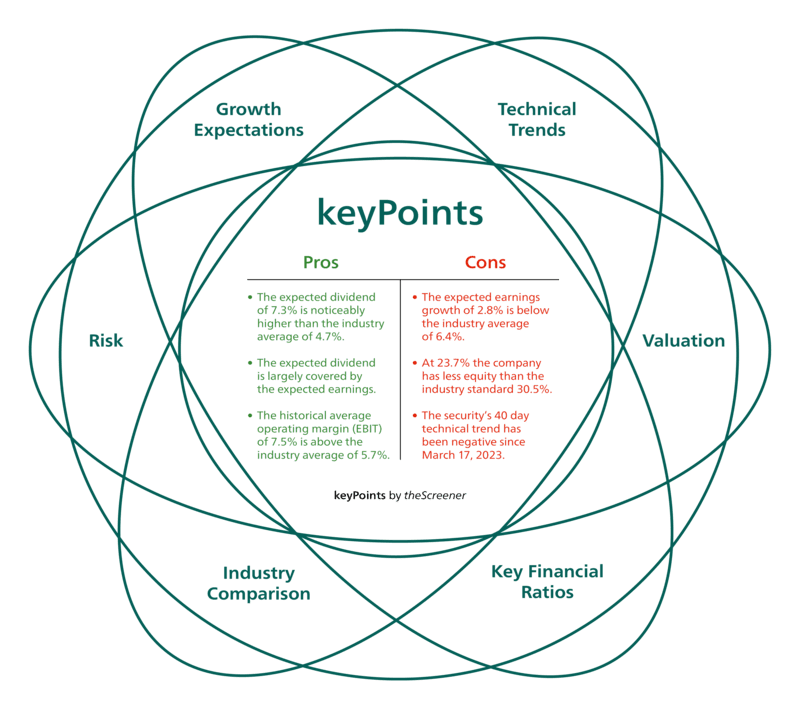

theScreener keyPoints

theScreener keyPoints is the concise summary of the most characteristic positive and negative investment facts. Based on a vast and further increasing set of quality-controlled data, our proprietary algorithm identifies trading-relevant facts of a stock and provides this insight as compact sentences in several languages.

theScreener keyPoints considers, among others, the following aspects for each stock:

◊ Financials

◊ Performance

◊ Industry and Market Context

◊ Analysts

◊ Risk

APPROACH TO FUNDS ANALYSIS

Our analyses are conducted once a week (on Wednesday) using the previous closing price.

Global Evaluation

The Global Evaluation is designed to give a fast and easy yet broadly supported evaluation of a fund or ETF. It combines the impression of fundamental and technical elements (valuation, earnings revisions, technical factors, group benchmarking) with the sensitivity rating (Bear Market & Bad News Factor). A better rating in the individual areas leads in the sum to a better Global Evaluation (scoring model).

Best possible rating ![]()

Weakest possible rating ![]()